Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

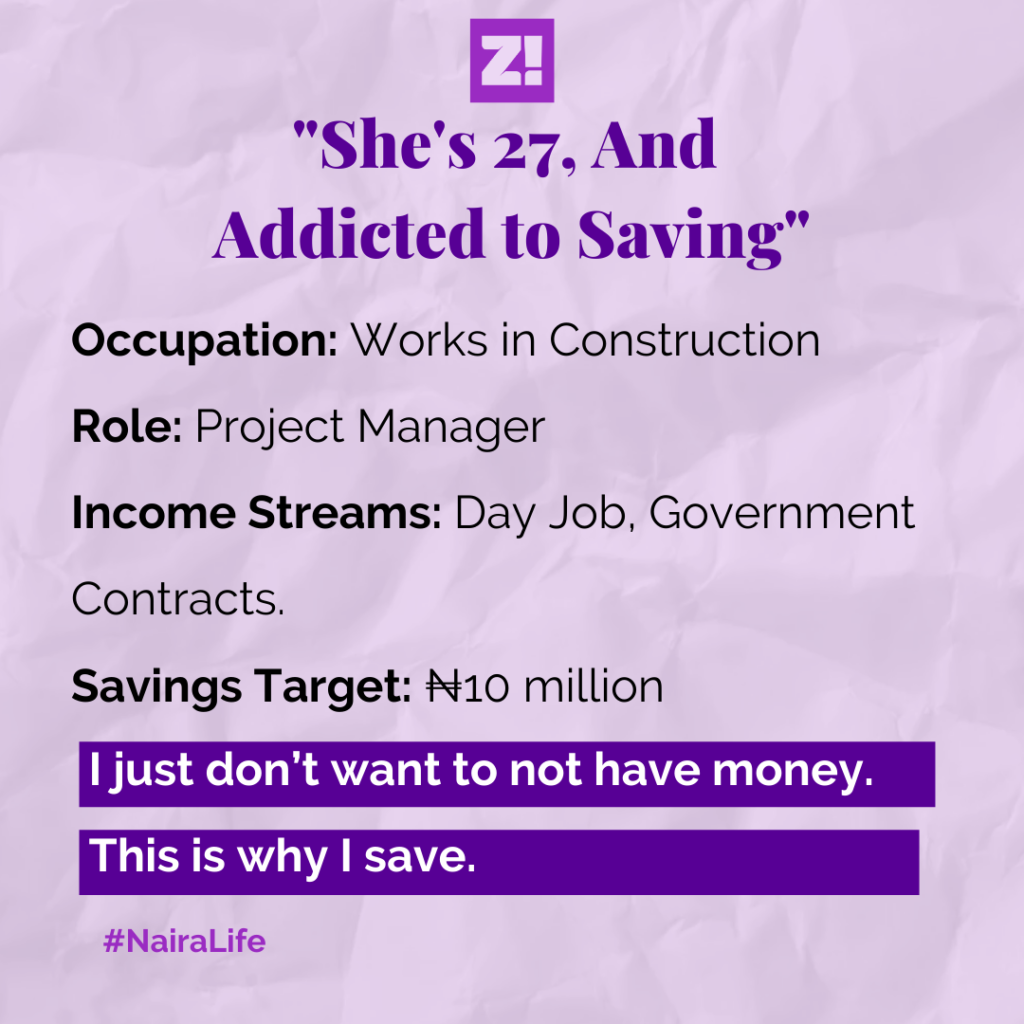

The subject of this story has a compulsive need, not to spend, but to save. Amongst other interesting takes. Read up.

What was the first thing you did for money?

Industrial Training while I was in school. I was earning ₦1k per day. He, the owner of the company, asked, “how much do you want to get?” And ₦1k was what I said.

I think I should have asked for more. I was hoping for ₦20-25k, you know some months have more days than weekends.

What kind of company was it?

A construction firm. Towards the end of my I.T., I got another placement for the last two months, so I was juggling the two gigs. I would stay for one week, then I would call in sick to go to the other one. Those people were paying me ₦7k, but the experience was worth it. The other place was paying me more, but I wasn’t gaining so much; it was like free money. This was in 2012.

What did you do after that?

I had a few free months before NYSC, so I felt the need to do something. There was this family friend, he was rich and into construction. I told my dad to talk to him, but nothing came out of that, so I was home for three months.

But one month before NYSC, he called me to come work for him. There was no agreement or anything.

Two days after I started, he was travelling and gave me ₦10k – It was such a big deal to me at the time. I was like “can you travel everyday so I can get 10k? Thank you very much.”

Somehow, I always got money everyday I went to work. I was getting free transport to work, and sometimes free lunch.

What were you using your money for at the time?

Nothing, so I was saving it under my pillow. After a week, I’d find maybe ₦10k there. I did that for like a month or so, then NYSC came.

When?

November 2014. So I took all my savings to camp. My boss bought a ticket for my flight. I think my dad gave me ₦10k, which was like chicken money. My first savings was what I spent in camp.

That was when I realised that I have to be conscious about my finances. I didn’t spend everything when I was at home, and that made me feel good. Also, I think I was the only Corps member earning ₦40k every month.

How o?

I got a job working in a construction company somewhere in the Southwest. ₦20k from my PPA, and ₦19,800 from NYSC. allawee. Cost of living was cheap, so I had so much money, with nothing to spend it on.

I saved some money with my friend, and the person chop am. I still haven’t gotten it till today. I was saving additional 20k every month I could. What’s important to me is that I had ₦200k at the end of NYSC.

You had to 200k in cash right after NYSC. That is lit.

Yes, the best part is that I continued at the firm where I was serving. But there was a small setback.

Ah, what happened?

My boss said he would start paying me ₦30k in a month. I was devastated. How do you go from ₦40k to ₦30k? So, I had to mostly depend on side money.

Side money? From where?

People come to the construction site to buy our ‘waste’ – empty sacks, wood, and even leftover sand. Also, I could make some money on the side from small projects, a drainage construction here, another one there.

Fair enough. So you were on ₦30k a month by the end of 2016

Yeah, but at the end of 2016, I had ₦500k.

Slow down, please. How?

I was still saving. I didn’t really have anything I was using the money for. That first 200k I had, I think I removed only ₦50k out of it. Most of my money goes into just buying basic necessities. That December, I withdrew another ₦50k, just to detty December small.

That is insanely frugal. How much did you make from side gigs on a good month?

It varies. Some months were very dry when there’s no site running. In those dry times, my boss didn’t pay for as much as 5-8 months.

Wild. How did you cope?

Some months, we can see ₦200k in a week.

That escalated.

In those days, my running cost was like ₦10k per week. Now I’m like, how did I survive on that?

I feel you. Back to the end of the year and the 500k that you didn’t know what to spend on.

Ah yes. I bought a car. That cost ₦2.7 million.

That’s interesting math. Let’s break it down; how do you buy a ₦2.7million car with a 40k salary and 500k savings?

Hahaha, I didn’t buy it immediately. I made more money in the early months of the year, so I saved more aggressively. My boyfriend added like ₦150k. I sold the previous car I was using – my parents bought it for me when I was in school for ₦400k. They also gave me a loan. Of course, my boss was not paying salary. From whatever I got from the site, I would save. At this stage, they had increased my salary to ₦45k. So when he paid like that, I would pay my backlog if I was owing.

By July, I had made my first million and I felt fulfilled.

That is incredible.

2017 was a really good year. I bought the car. I was earning ₦45k but I was saving about ₦100k every month.

Tell me about that day your car arrived.

I wasn’t totally excited. It was a good feeling, but I think when you save too much, inconveniencing yourself in the process, it doesn’t make it feel rewarding. I was just like “this is what I get for all these years of starving.”

Anyway, I was still earning ₦45k till September 2018 – it became ₦80k by October. I didn’t save so much in 2018, but I had about ₦500k in savings. Around this time, I started pressing for two contracts, but I managed to get one, but I can’t exactly track how much I saved from that.

Wait a minute, you pitched for an actual government contract?

Yes, but with someone else’s company. I’ll explain how it works; Government gives the contract to who knows who, but they really can’t execute it. They just have the connections. So there sell the contract to someone else, a person who can execute.

This contract in question didn’t even belong to the person who sold it to me. I was the third contact. So the contract was originally ₦13 million, but what got to me was ₦4.5 million.

Wonderful. What were you supposed to do exactly?

Construction work for a government building.

I got a ₦2 million loan from one of my parents to kick start this thing – I needed to make a ₦1.7 million commitment to the project at the beginning. The project started before the end of the year, and I quit my main job. I told them I felt I was underpaid and undervalued. I think there were still owing me ₦20k sef.

My final act for the year was a job interview in Lagos.

How did that go?

I got the job, they offered ₦250k, the highest anyone ever offered me at a day job. I still went on to execute the project. My net was ₦217k though. I resumed in February, so I had time to execute the project properly.

What did that look like at the end?

By the time we finished proper, ₦4.5 million was left. I sent a message to my sister and said, “Is it weird that I’m 4.5 million richer, and I’m still just like duh?” She thinks I’m weird.

I think, over time, I don’t really see money as a big deal anymore. It doesn’t give me so much joy. Besides, I know I’m not going to be spending this money, not using it to flex or anything.

Wait, so 4.5 million out of 13 million. What happened to the remaining ₦8.5 million?

The rest went to actual execution and commission to the people in the chain that sold the contract to me.

All of this was while still having a day job.

Yeah, I was working on the Operations team. So on weekdays, I’d do my 9-5, then weekends will be spent supervising. This meant I had to travel out of Lagos every weekend – it was somewhere else in the Southwest. I had to make my money. You know, I haven’t even spent that money. I just gave it to one of my parents to hold. I still have a savings target to meet.

What’s your saving target this year?

₦10 million. I’m currently on ₦6 million.

That’s wild. What was the target last year?

I didn’t have one. I think I lost focus last year. By the way, within the first 6 months of my new day job, I got a raise from ₦217k to ₦293k to ₦297k to ₦320k.

2017 was an interesting year for you, but 2019 is on steroids

Like! But then, I have so many things that have taken my money since I moved to Lagos. For example, I have this friend that likes to eat at fancy restaurants. They will bring our bill, and it’s 40-something thousand naira. I’ve decided to stop sha. That savings part of me is coming back. Also, I live with family, so I don’t have to pay rent.

Currently, what’s your running cost every month?

I spend like ₦15k on fuel every week. At least ₦3k on data and airtime. But most of my expenses are on food. My expenses just never cross ₦200k. I try to be useful as a family person. If my sister says she needs something, I want to be able to do it.

I just save the rest. From May till August for example, I was able to save like ₦2 million.

How? Where did it come from?

So, towards the end of the project I was executing outside Lagos, another one came through. That whole contract was valued at over ₦150 million.

Woah. Did it have to be that much?

The government contracts I’ve executed actually cost 40-50% of the total sum to execute. This is what happens to the rest of the money; they go to politicians and the original awardees of the contract. If you buy a contract at 15% of the value, for example, you use 5% for PR.

What’s PR?

It’s for the PAs, the secretaries and co. “You heard about this job, oya you sef collect.”

So for example, some politician will come and say, “Oya o, I have ₦1 billion I want to spend next year. How we fit do am?”

“Oya, let’s build a hostel here. Let’s build classrooms there. Build one football pitch in that state.” The politician aka facilitator gets a cut, the contractor gets a cut. Me? I don’t like a lot about how these things work, but I also have a job to do, and I do it well every time. And then I get paid.

All these years since that IT money, what’s your money hot take these days?

I think you should just have money. Having money gives me peace of mind. I want to wake up and say I have money somewhere. Also, I believe that if you can’t save up to 60% of your income, you are either at a shitty job or you live a shitty life.

I’m trying to understand where this obsession with saving comes from.

I just don’t want to not have money. I start to think there is a problem if I’m not saving. The first few months I didn’t save when I got to Lagos were tough. I felt like I was cursed.

Have you considered investments?

With my parents, mostly. I gave my dad 500k in 2016, I was getting like 10% every two months. My dad is into the supply of produce for all these FMCGs. In my house, everything is business. If you owe me 1 naira, you have to pay it back. We don’t play.

When I have enough capital, I want to buy trailer-loads and supply too.

What do you mean by ‘enough capital’?

30-50 million naira. That would give some financial stability. Say I do business with that, I should get 5-8% in returns monthly on that.

I want to ask how much you’ll be earning in 5 years, but I feel the need to ask about how much you’d be saving instead.

Yes please, let’s say saving. If I do 10m this year, maybe I will do another 10m next year. But in the next 5 years, I hope to have 50-65m. I haven’t figured it out yet, but I think I’m working on it. We die here!

Do you ever worry about things like inflation that makes money lose value?

Yes, I used to worry about that. But right now, my parents use it for business, and put it work, and I never have to worry much about it. So I’m good.

What’s something you want but can’t afford?

A vacation.

But you can afford it

I can’t afford to take anything out of what I have saved. It’s sad, I know.

Incredible. Do you have a pension, insurance and all those stuff?

I had one in my former company. I think I had ₦70k in it. I never bother about it really.

On a scale of 1-10, how would you rate your financial happiness?

I think I’m just there. There’s still room to improve. So maybe 6.

What’s the weirdest feedback you’ve gotten about your lifestyle?

It’s not weird, it’s the way it is. My family tells me that I’m stingy to myself, and I’ve come to realise how true that is.

I can’t help it; it’s just the way I am.

P.S: This conversation was had a few months ago. I checked in on her ₦10 million savings target. It will be achieved by December.