Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This #NairaLife is the story of a medical student stuck in a loop that is the Nigerian education system. One day, he got some information that changed his life forever, and he went from being a dependent to a provider. This is how it all happened.

Let’s start with the first time you worked for money.

2009. I used to help my cousin out at her tutorial centre which she’d just built into a school. I was 16 at the time and still in senior secondary school, so I only had time during the long vacations. She paid me ₦4,000 every month for my troubles.

Do you remember what you did with your earnings?

The memory is faint now, but some of the money must have gone into buying stuff I needed for school. There were also the times my mum would ask me to loan her money. Of course, she never returned it.

Don’t we all have that story. What did you do next?

University. I was admitted to study biochemistry in 2011 though I wanted medicine and surgery. I lived in the same town as my parents, so they didn’t put me on a big allowance. They sent me to school with foodstuff and sent ₦2,000 occasionally. I could come home whenever I wanted, and they knew this.

I still wanted to study medicine, so I tried again in 2012. Another no. When I tried again in 2013, I changed my institution of choice to Kogi State University. There I was offered a course I didn’t want, and I rejected it.

I decided to let medicine go, until an uncle asked me why I wasn’t studying it. He convinced me to give it another try and even paid for my JAMB exam. I got it this time. I was already in 300 level, but I transferred to the college of medicine and started again at 100 level.

Omo. What did your parents think about this?

They were fine with it. The only problem was that things were rough at home at the time. My tuition was ₦80,000, and my father couldn’t raise the money. The loan he applied for at his cooperative was not approved. For a minute, it felt like I was going to lose my admission. But my dad got the money and it worked out.

The real problem was that the college of medicine had their own issues too.

What issues?

The college was struggling with accreditation. There were people who had been in school for six years but were still stuck in 300 level. The thing about medicine is that if a class writes a professional exam this year, the next class must wait till the following year before they can write the same exam. But we weren’t writing these exams, so nothing was moving.

The provost of the college called my class and candidly told us that we had a long way to go. We were supposed to write our first professional exam in 2017, but he said the earliest that could happen was 2019. That was two automatic extra years.

Nigeria.

Sometime in 2016, some senior students protested against the recurring accreditation issues or increase in school fees — I’m not sure anymore. The college didn’t take kindly to that. Apparently, “Medical students don’t protest”. They sent all of us home indefinitely.

Mad oh. What was it like being stuck at home?

Omo. I was almost 23 years, and school had no end in sight. My dad took it the hardest. He was so terrified because he was close to retirement, and he worried that he wouldn’t be able to afford my tuition, which had increased to over ₦200,000. I felt like I had made a mistake. My classmates in biochemistry graduated that year. That could have been me

Sorry, man. Must have been tough.

It was. I knew I had to figure out a way to start earning. I remembered a guy I met on NairaLand in 2013 when I was considering Kogi State University. We became friends and remained in touch, although I didn’t get into the university. There was a time he showed me his earnings during a conversation, and my immediate reaction was, “Ah, Yahoo Boy”. He explained that he made his money from freelancing and tried to sell it to me. But I was like, “If you’re earning in dollars, you’re a Yahoo Boy.”

LOL.

Sha, I reached out to him to take him up on his offer, and he sent a few links to get me started. I did a bit of research and opened an account on Fiverr. This was September 2016.

When did you get your first job?

Not long after I opened the account. It was a video script gig, and the client’s budget was $5. I had never written a script before, but I took it. I messed up the job. Understandably, the client was upset and left a bad review. 2/5 stars.

Ouch.

I went back to the internet and dug up everything I could find about scriptwriting. I got another job — another chance to learn. It wasn’t as bad as the first one, but there were some disputes about the quality of the work. I had a dry spell that lasted a few weeks until an animator contacted me to write a script for a project his client was working on. He also offered to pay $5. This was the first job that went smoothly, and I got my first 5-star review.

Lit.

I was interested in scriptwriting now, and I spent hours learning all the basics while applying for jobs to test my new knowledge. Every time I saw something interesting that I didn’t know how to do, I would apply for the job. If I got it, I would do it, make my mistakes, get bad reviews sometimes. But I was learning a great deal from all of them.

What was the review that hurt the most?

I can’t remember oh. There were quite a number of them. White people don’t have joy, I swear. I didn’t worry too much about them. I knew they wouldn’t matter in the long run. Within three months, I had gotten considerably better at scriptwriting.

In December 2016, I made a little over $600 from a series of gigs. A video script here, an ad copy there. This was about ₦200,000 at the time. I thought I wouldn’t make more than ₦30,000 a month when I started three months earlier. On many levels, that was my big break.

My heart is full. When did they ask you to return to school?

Oh, that. They asked us back in February 2017. They actually took their time and wasted ours because they knew if we returned to school, they would have to start dealing with their accreditation issues again. About four months later, the school told us that there was still no accreditation and that there was a backlog of classes who hadn’t written their professional exams, so we should go home again. They called it a holiday,

Ah.

There was no return date this time either. I was like, “I can’t lose on both sides.” I returned home and continued writing scripts. It was during that period I learned how to write movie scripts. That did numbers for my monthly earnings, It grew to at least $1,000 a month.

What was the average amount you made per job?

I’m not sure. It was a mix of small and big jobs. I was still taking the small $5 jobs because they improved the bottom line as well. But as I got more 5-star reviews, I increased my gig prices. From $5, I moved to $10, then $20. Now, a project’s budget must be at least $50 before I consider the job.

Nice.

I saved my first million before my 24th birthday in 2017. It was huge for me, man. At this time, I was already helping out at home. Oh, this reminds me of a story.

Tell me about it.

My dad needed some money — I don’t remember how much — and I gave it to him. I wasn’t ready for what came after. This man was so choked by emotion, he started to cry. He was like, he wasn’t sure things were going to change, and now, I was making it happen. It was a sweet experience.

Aww. I get what you mean.

Besides, I could afford anything I wanted. I didn’t live an extravagant life, but I knew I wasn’t in dire need of money. There’s a relief that comes with that sort of realisation.

I feel you. Did your school ever call you back?

Oh yeah. We spent the rest of 2017 at home. We returned in January 2018.

I’m curious about what this erratic calendar did to you.

It didn’t matter how I felt; I had to stick with it. My parents would be so disappointed if I dropped out. I toyed with the idea of transferring to the Philippines to continue school, but I feared what would happen if I stopped making money and couldn’t sponsor myself anymore. This might be one of my biggest regrets.

And oh, they sent us home again. It was an internal ASUU strike this time. School has been on and off since that time.

Bruh! Back to your hustle: how has your approach to getting jobs between 2016 and now?

I sent a lot of proposals when I started, but I stopped applying for jobs in 2017. These days, I let clients come to me to tell me about their projects. Then I create a custom offer for them. Marketing is key when you’re a freelancer.

Word. How do you know the kind of jobs to accept?

I don’t accept jobs I know I can’t do. I get tempted to accept them and outsource, but I don’t because I know whoever I give it to might fuck it up and mess up my review. Yes, I take those things seriously now.

Lmao. What do your earnings look like these days?

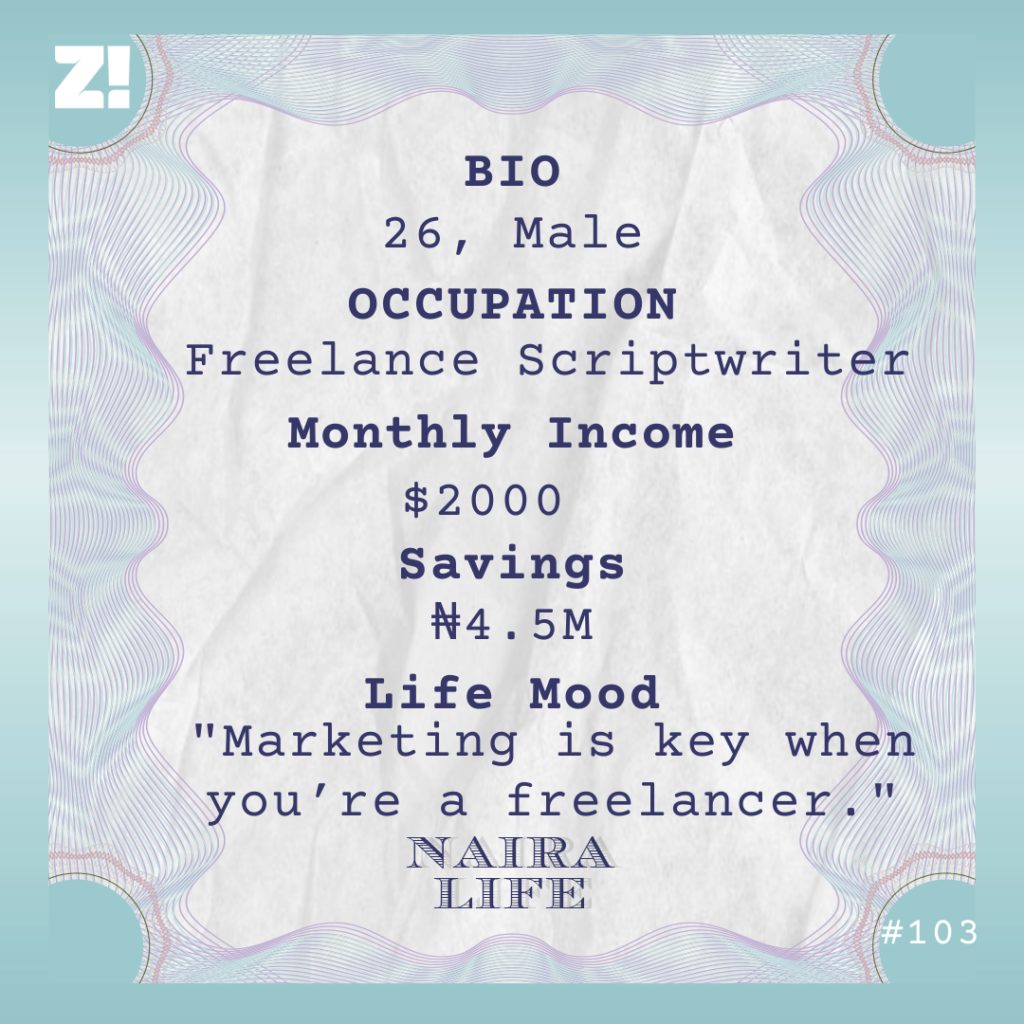

I didn’t pay a lot of attention to this until recently. I did a review of my monthly earnings, and I found out that I make at least $2,000 every month. While that seems impressive, I feel like I could do better. I’m one of the little earners in my circle — others make between $5,000 to $10,000.

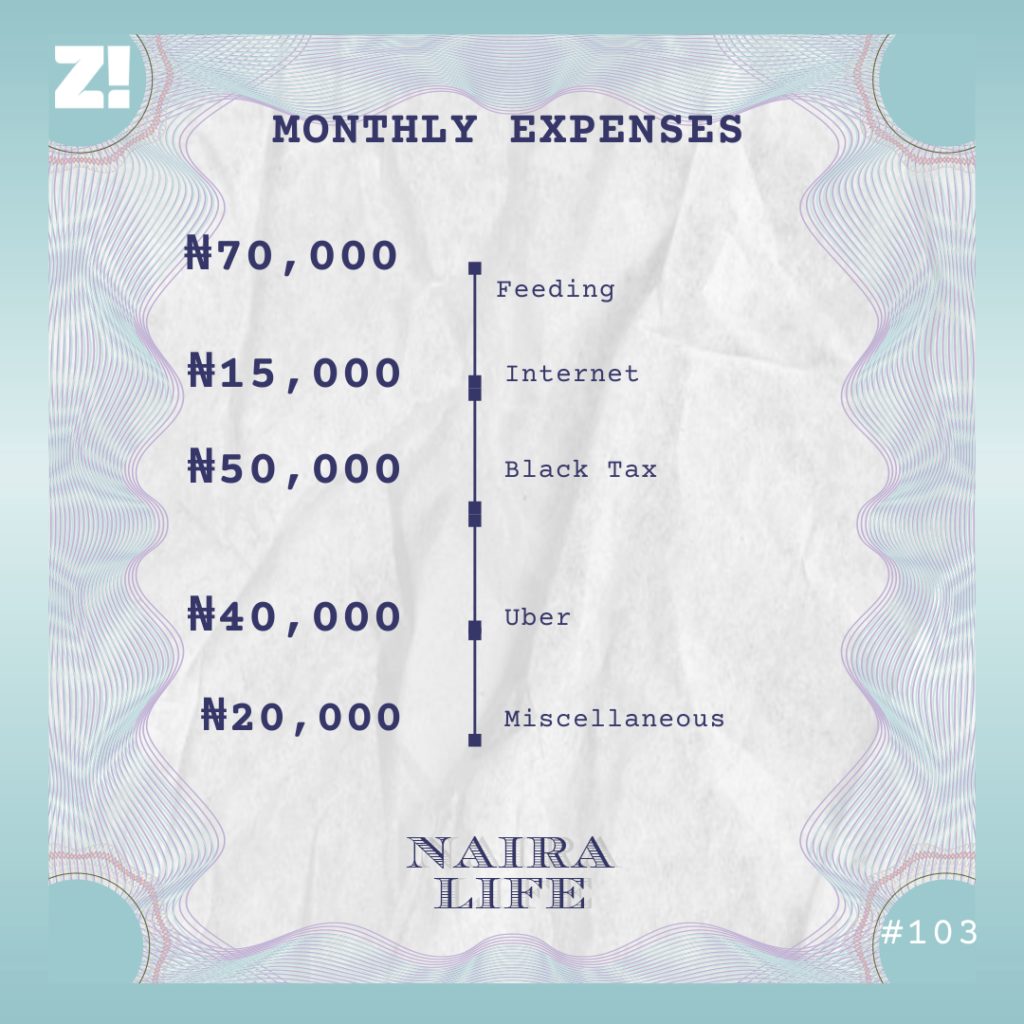

$2,000 is about ₦900,000. Let’s break down your expenses.

Tell me about your miscellaneous expenses.

I don’t pay tithe, so I donate some money to people who I think might need it. I find a lot of donation links on Twitter. My parents don’t know about this because I tell them I pay my tithe to another church.

Speaking of your parents, what do they think about the income jump?

Haha. When I got my first job and told my mother about it, I didn’t leave out the part about the client being a white person. She heard that and went, “Eh, white man. Are you sure you’re not doing Yahoo Yahoo, this boy?” My father heard about it and forbade me from doing anything on the internet.

My church people too started talking and asking my parents if they knew what I was doing. It was hard to explain, but they’ve come around. My parents pray for me now.

Hallelujah. Let’s talk about your savings.

I’ve not been saving a lot since last year because I started to invest in properties. I did save ₦4.5 million last year. It’s sitting pretty in my Piggyvest account.

Lit. Tell me about your investments.

Here’s how it started: in 2018, my dad wanted to build a mini-flat so he could have something to bring in money when he retired. My mum roped me into the project. I spent about ₦2.5 million on that and didn’t get it back. In 2019, my dad told me about a land a cousin wanted to sell. He thought it was a good opportunity and asked that I buy it. A plot was ₦250k, and I wanted to buy one. But he talked me into buying four. That took ₦1 million.

That’s really interesting.

I took land investments seriously last year. My cousin pitched the idea of buying lands in a state in the South West. We got on it and bought a plot of land for ₦1.2 million. I’ve spent an additional ₦5 million developing it.

Do you have any plans for it?

I don’t know at the moment. I’m leaning towards renting the apartment out, but my cousin wants me to live there. I wasn’t even ready to start building anything on it, but they said they could snatch the land away from me if there were no signs of it being developed. Omo, the first thing I did was to build a fence around it.

Lmao. Apart from these investments, what’s the biggest thing you’ve spent money on that required planning?

In 2019, I went to Dubai on vacation after I wrote my first professional medical exam. The total package was about ₦500,000. I clocked that I liked travelling and decided to do it more often. I’ve been to Ghana, Malawi, South Africa, Rwanda and Ethiopia between then and now.

Where do you see all of this in five years?

I’ll be out of Nigeria, hopefully. But if I’m still here, I hope to have grown my business into $20,000 per month. I’m not sure I will be a practising doctor. The way doctors are treated in this country doesn’t sit well with me.

Is there anything you want but can’t get right now?

I’d like to buy a car but I’m scared of the police. Also, my parents are worried about people thinking I make my money from cybercrime. Ah, they also believe that witches would kill me too.

I’m not even going to touch that. On a scale of 1-10, how would you rate your financial happiness?

7. I’ll be honest; I don’t worry about money these days, but earning more would be great. Sometimes, I wish I could be more spontaneous, like taking my friends out on vacation and paying for all of it.

I feel you. How’s school going, by the way?

I’m about to start my fourth year now. I wrote my first professional exam in 2019. I’ve spent more time out of school than in school between the time I became a medical student and now. But you see that ₦4.5 million savings I have in PiggyVest? That’s my japa money when all of this is over.