Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Tell me about your oldest memory of money.

As early as 16 years old, I was already creating my path to financial independence.

Even during the ASUU strike in my 100L, I decided to get a job. Why? Because I wanted to foot my own bills. I decided I was done asking my big sister for weekend money and the likes, so I decided to go job hunting.

My first job as a salesperson at a boutique lasted only 5 months because I had to go back to school. My pay was ₦10,000 and man, did it mean a lot to me back then.

I felt this new sense of self-worth after being paid at the end of the month.

Whenever I received my salary, I’d create a shopping list straight. Then in 2013, I decided to start a tutorial business while in school. Sadly, it didn’t go well; I like to call it my first example of a failed business venture.

Why do you think it failed?

I’ve not really asked myself that. I think I focused on a small number of people. Over the years, I’ve learned that for a business to scale you have to cut across a large number of people. So, I didn’t do enough publicity. Lesson learned.

What did you try next?

Upon graduation in 2016, I decided to learn how to sew – that cost ₦50,000. I registered in a fashion school to acquire tailoring skills, that was my next venture. Making clothes to make people beautiful and make me money.

My training lasted for 6 months; then, I started taking orders, showed people what I made, told them I made the clothes I wore. And boom, I had clients and money taking gentle steps into my account. It felt good.

How much did you charge on your first order?

₦3,500. Even after getting employed I continued sewing, it served as an extra source of income. For some reason, I have never believed in having only one source of income. In fact, this helped me because for the first 7 months after NYSC in 2018, all I did to earn money was sew.

My room was my workshop. I had clients in Lagos, Port Harcourt, Kaduna, it was interesting. Friends saw my work on social media and placed orders. The concept was to get large orders. At one point I thought of making ready to wear and sending them abroad to my relative to help me sell and then get paid in dollars.

Sadly, I wasn’t even saving my profits, or investing back into the business, or getting better machines. I was really excited I was making money, but my money was going from my income column to my expense column. Haha!

Then financial literacy.

You had to learn financial literacy?

Oh yes. I always knew the word ‘saving’ for example, but never applied it. Then I read the first of the Smart Money Woman series. Then everything changed. Luckily this was around the same time I got my employment into a logistic company. I joined in November 2018.

How much were you earning on the average month while sewing, and what was the logistics gig paying?

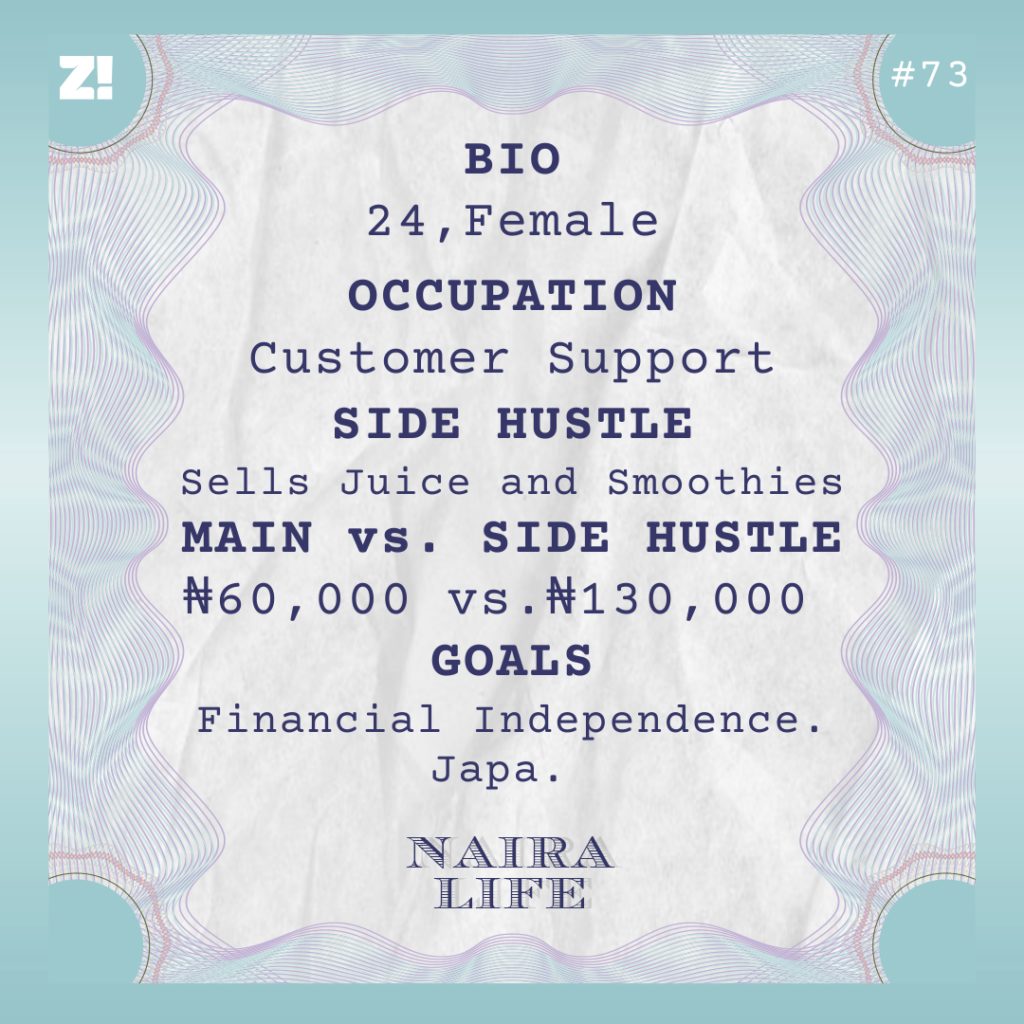

I was making about ₦60,000 and the company was paying around that same amount. The job got so demanding, so I had to stop taking orders to make clothes, leaving me with just my salary as my only source of income.

How has your income grown in this period?

Mid-2019, I decided to start another business — a smoothie business. My smoothie business has grown so much that I make 3 times more than salary from it. It has really been challenging, combining work and this juice business. I have to wake up 4am daily to prepare the juice and smoothies, then deliver them before going to work. But not only has my income grown, but also my financial literacy. Every month I save between 65-70% of my salary and 80% of my business proceeds.

My 9-5 salary is about ₦60,000 and on the side I’m making close to ₦200,000.

Wait, you haven’t gotten a raise since 2018?

No. I was wondering what financial growth I could achieve with that pay, so started thinking of how to make more money on the side. That was what moved me to start my juice business. It pushed me out of my comfort zone.

About the raise part, it’s a one man’s business. Structures don’t really exist. I basically see it as a place to acquire some business/organisational skills, learn about the marine sector, know a little about a lot, before transitioning to the next thing.

What’s the next thing?

Travelling to a country that actually works. Alongside saving a lot of money to invest in the stock market – not the Nigerian stock market though – and real estate.

Ah, Canada?

Our second country – but not necessarily there sha – there’s also Australia.

I see you’re pretty military about money.

I grew up in a household where all the women were really financially self-empowered, and this rubbed off on me. Then I read Arese’s Smart Money Woman, and it did a lot of work

How has the pandemic affected your juice business though?

Thankful to God, it didn’t affect my business. At the beginning phase of the lockdown, I thought it would but instead, it boosted it. I market my products as immune system boosters.

Tell me more about this fruit business.

I supply fruit and vegetable juices, smoothies, tigernut, zobo and so daily. It’s a subscription based business. People subscribe daily, weekly, and monthly. On a daily basis, I supply between 18-25 orders, which generates between ₦10,000 – ₦15,000 daily revenue.

I target gyms, sporting centers, offices and supermarkets within Festac. But because of the nature of my job, I have not really been able to supply as much as I want to.

Have you ever considered a world where you did this full time?

Definitely. During the first stage of the lockdown when I thought I would lose my job, I decided to do my juice business full time and focus on really expanding the business instead of applying for another job. I got 4 new customers during the lockdown, and lost some old ones too because of the closure of some centres.

So, we’ve talked about the revenue from your business. But how much does it give you in profit on an average month?

₦100,000 – ₦130,000.

Well done. Let’s break down your expenses on a monthly basis.

My salary is ₦60,000, I divide my expenses budget into:

- Groceries:

- Transportation: this is a 15-minute trip.

- Food: I don’t eat out a lot.

This comes from about 30% of my income – that is ₦18,000 – while I save the rest. From my business, I use 20% to buy groceries and save the rest. So, let’s say I make ₦130,000, that means it’d be ₦26000. Then I save the rest.

I also invest into my business and I’m gradually growing my money to invest in real estate.

Why are you saving so much?

I want to relocate, then do my Masters. It’s a project I want to do for myself by myself, with no assistance from anyone. Honestly, I want to start life afresh in a better country.

I feel you. Hypothetically, if you weren’t going to do it by yourself, where would you get help from?

My family. But I won’t because I want to handle this adulthood journey 100% on my own and definitely with God’s help.

Would their support be an inconvenience to them? Like, they love you and all that, but would it be difficult for them if they had to raise a lot of money?

No. But financial independence is something I’m gradually achieving. The last time I even collected money from home was in 2017 when going for NYSC. This attitude has moved me to do more for myself, push me out of my comfort zone and think of how to create wealth for me.

So, I imagine you have a savings goal for this project, how much are you gunning for? How long have you raised?

Let’s say about ₦5million, and I’ve saved about ₦1 million. 8-9 months.

How long do you think it’d take to get to the next million?

An average of 7 months. But I don’t need to have all the ₦5 million before going though. Just half or more than half, I will continue the hustle when I get there.

Is ‘there’ Masters or Abroad?

I intend to do my Masters abroad. When I get there, I’m getting a job or two to foot my bills.

What’s something you want right now that you can’t afford?

Relocating.

Hahaha. The Japa is the only direction your compass is facing. When did you first realise you wanted to leave?

2012 when we travelled to the UK for summer. I got lost on my way back home. Unhappily for me, I found my way home, I –

Wait, you just intentionally got ‘lost’?

Hahaha, no I didn’t. I was so angry because I didn’t want to return to Nigeria in 2 days with them. I have always known this country is not for me.

Hahaha. Sorry, a segue; what’s the last thing you paid for that required serious planning?

I can’t remember o. Since 2018, I’ve been really keeping my life simple to save more.

Fascinating. Because you plan a lot, I imagine that you don’t get hit by a lot of miscellaneous.

I have always been a simple person; I buy only things I need. I was about to order a hair worth ₦60k this month but I was like no that’s almost the price to apply to 2 schools for my masters program – ₦70k. Somehow, I always have the bigger picture in view.

Please, do you ever spoil yourself?

I get asked this a lot, but I’m a really boring person and this helps me stay focused. Truth is, I need to stay focused to make the kind of money I need to spoil myself with — somewhere in the Caribbean sipping cocktails on a boat, hahaha.

So, you’ve raised the ceiling for what you’d consider as enjoyment. What are your small pleasures?

Gowns. I love gowns and shoes.

How would you rate your happiness levels, on a scale of 1-10, and why?

11, I broke the scale, hahaha. I’m an entire vibe of happiness on my own. I don’t even know how I do it, staying happy and excited.

What excites you?

Life, nature, good people. I lost my mom when I was 10, and surviving life, growing up successfully without a mother makes me see life differently. Makes me want to stay happy about so many things because today they are here and tomorrow they are gone.

I feel inspired by my mom’s story, how she came from a poor home, came to the city did a whole lot for herself and her family before she died.

So sorry about your loss. I’m curious about your dad.

We live together and he has been bringing me up all along. Although sometimes, he gets sad I don’t talk about marriage and starting a family, it’s always about how I want to grow financially.

Me? I just like setting goals and challenging myself to achieve them.