Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Quick One: The guy in this story has a serious knack for just hustling for money, and it drove him to do menial jobs as early as age 13. Let’s get into it!

What was the first thing you did for money?

When I lived in Kano, there were people who were selling rams, so I’d pick the hull of beans, and sell to the ram sellers in sacks – this was in 2001. Then I tried conductor work out of stubbornness. The driver paid me 500 that day, but someone saw me and reported to my dad. That ended. We moved to another state, and not too long after, I secretly started pushing wheelbarrow on Fridays. I really didn’t want to depend on anyone at home for money at that time.

My dad never found out, because I knew that if he did, he might just say, “you’re going to pay your school fees with that money.”

We moved again, and in the area we moved to, it was just developing, so there were a lot of construction sites.

Did you move a lot?

Yep. I went to seven primary schools and six secondary schools, because we kept moving. So unlike most people, I don’t have primary school friends and secondary school friends. The only school I spent two years was the school I did my WAEC.

Wait, how old were you?

2003, I started helping out in construction sites, transferring blocks from one place to another. Then I started packing sand from a river. Basically, you’d pack a truck’s worth of sand, and then you sell it to trailers at about 1500.

A kid in Kebbi state dredging the Argungu River.

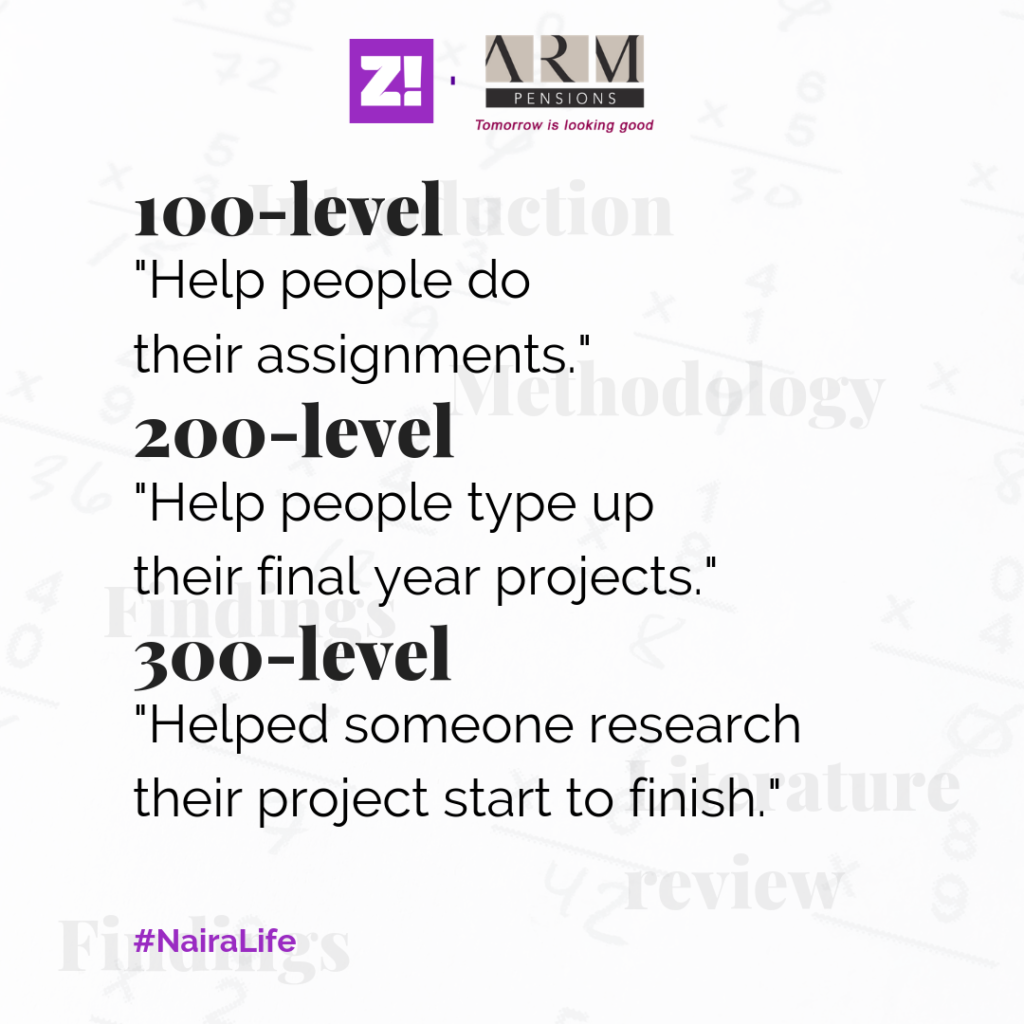

Nothing really happened till I got into University in 2007. There was this guy in school then who had a Computer centre. So I’d go there, help people type up their work, and give him a commission.

Then, people will call me from home and be like, don’t you need money, but I’d be like, nah I’m fine. The first project for someone was for a final year student, while I was in 300-level. Then I was on my way home after 400-level, and this student – a pregnant lady – was like, come and help me write my project. She paid me 30k in 2011. When I got back home, I was balling.

I graduated and went to serve in 2013. Then I started the job hustle, travelling everywhere to go and write job interviews. I travelled to Lagos to write one. I travelled to Kano to write another one. And so on. I sent CVs to my uncles and all that, nothing came through. That time ehn, I write cover letter tire.

Then one day in 2014, I got called that my dad was sick in the hospital. He died, eventually.

Woah.

Everything changed after that – I was 26 at the time, and I still had two younger siblings in university. Things got really tough, and we had to sell our house to fund my siblings’ education and stuff. Around that time, I made this friend in my compound at the time, who I can now call big brother, sort of.

He was like “did you send CVs to your uncles about job?” I said yes. And he said, “I’ll advise you not to wait mehn. Just wear your hustle cap, and let’s go and look for money.”

So I started following him to a Ministry in Abuja where he worked. That was how I started my agent work, registering trademarks and whatnot for people. I was learning the ropes, so I wasn’t really making money. I was running a lot of errands – making photocopies, submitting documents, etc. And because I was super comfortable with computers – from all the time I spent working on docs in University – they trusted me with it.

So then, I’d make 1,500 on some days, other days 3k. Some days, even up to 5k. Out of this money, I still had to support the family – buy food in the house, give out pocket money, fuel the Gen and all that.

I did that for almost one and a half years.

Must have been intense.

Sometime in 2015, someone tweeted about a job. I applied and got hired as a Social Media executive to get paid 70k a month.

What I didn’t realise was that the role was double fold. It was a tech company, and basically, I was hired to do Social Media work for one of their clients. But then, I also had to do social media work for the company that actually hired me.

So, the interesting thing I found out when I resumed at the company I was posted to was that I walked into what would be my office to see one person in a room that has five computers.

And she just looked up at me like, “oh they brought you here? I’m leaving, that’s why they’re bringing you. You go hear am.”

I should have listened to that lady, because what it meant was that I was doing the work of 5-6 people at the same time.

Then after work on Monday, my boss would come and be like, “let’s think through this,” “let’s do that,” “why is our output low” etc.

I’d recommend solutions, and he’d still come back and rant the next Monday. By the 3rd month, I sent in my resignation with no plan after.

I remember my line manager saying, “won’t you at least wait till the end of the month to collect your salary?”

Nah, I was done.

Crazy.

Also at the time, I’d already started looking for how to make money on Social Media. I’d get tiny gigs from brands promoting stuff.

My mum would just come into the room and be like, “what are you doing on your phone?” She had no idea I was literally make a living off that phone.

My first major gig came that year – 100k. It was huge. And I was like, this social media something might make sense o. So I invested in a better device – a Tab. I bought it for somewhere between 40-50k.

I doubled down, and started doing gigs for all kinds of brands and organisations, getting 10k here, 20k there.. The real big one came late 2015 – I got paid 250k.

‘Influencer Marketing’?

I legit made a living tweeting.

Then one day, a friend of mine emailed me about a company hiring. They were looking for a local researcher. I remember being in a bookshop a few days later when they called me and were like “Is this a good time? We want to interview you.”

“Of course it’s a good time.” By the time the call was over, they’d hired me on the spot.

It was a per diem role, and you know how much they were paying me?

Tell me.

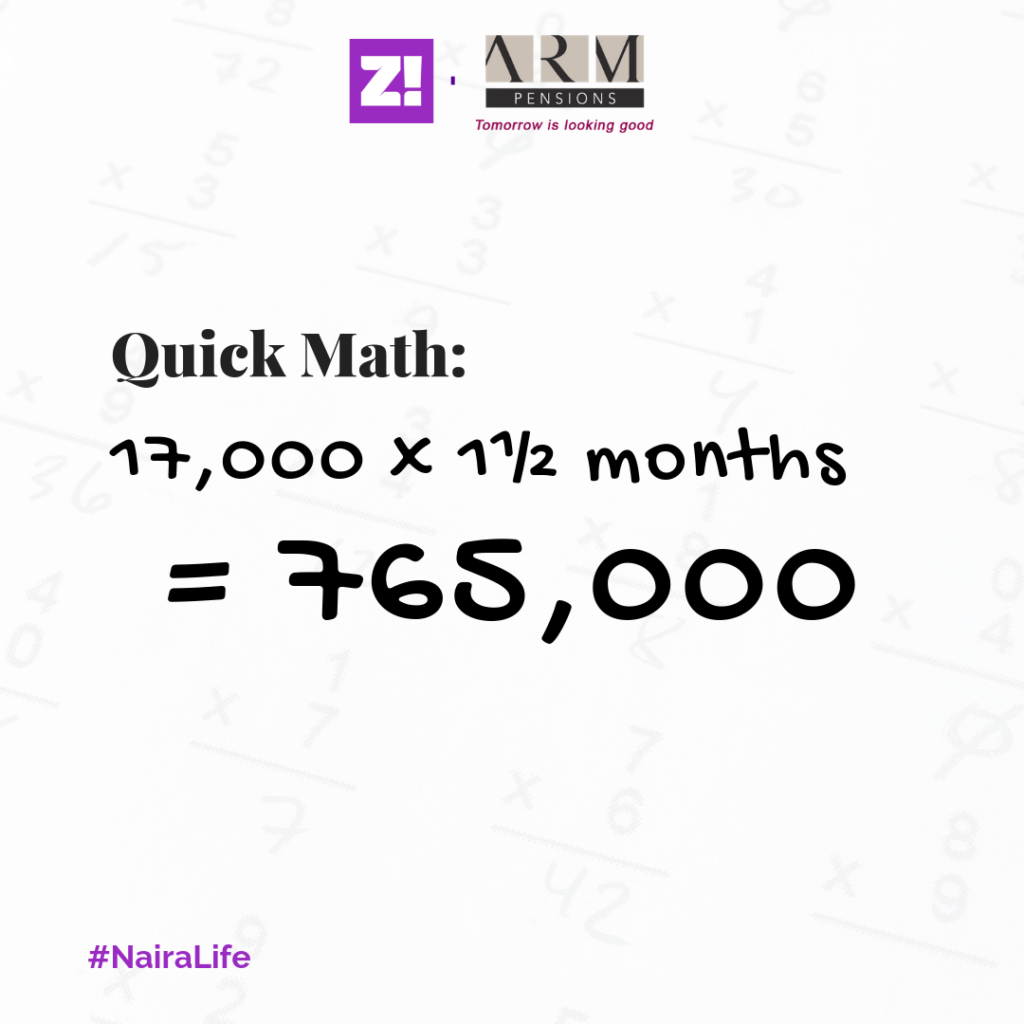

17k per day. I did that for a month and a half.

Omo, I was working everyday for eight hours. It was human-centered research, so I was doing what you’re doing with me right now – interviewing people and then transcribing it. I’d pick out the whats, whys, whens and hows of a story, and move on to another story. The research was basically about how people were using social media to demand accountability from government.

By the time I finished, the year was over, and I had so much money that I just wanted to go and chill. I gave my mum money as usual – I mean, I’d already started sending her money since I was doing my NYSC. After my dad died, it became my duty to make sure there was food in the house.

Ah, the first born struggle.

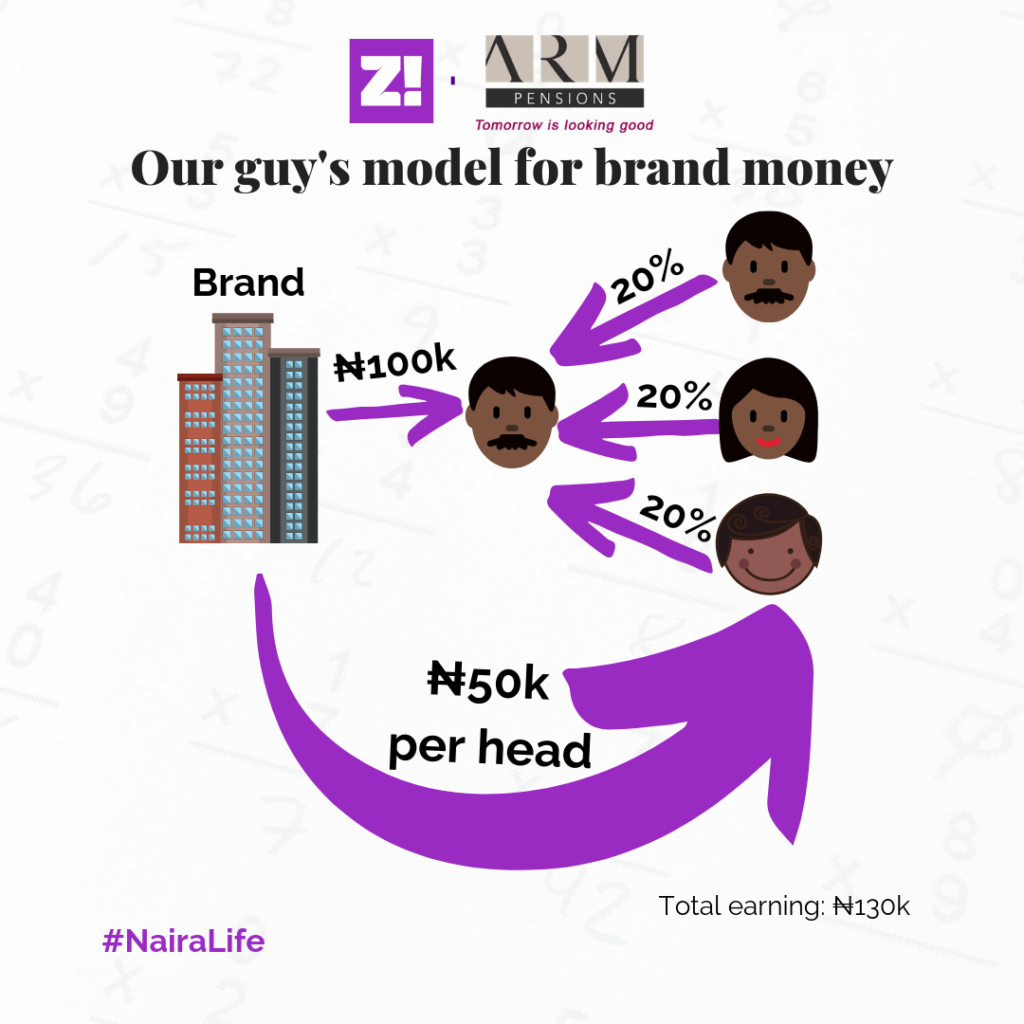

Yes. By January, the company that needed research reached out to me again. In all this time, my social media profile was also growing. People would reach out to me from companies, and say they needed someone to find people to push stuff on social media. So I’d raise a small team, push the gigs to them, get paid by the company, then get my commission from them too. So let’s say a brand pays me 100k, and want to pay the other people 50k. I’d get my 100k, then collect a broker commission from the remaining people – 20%.

It was a two-way model.

Add to that, I used to get some money from people commissioning me to do some writing for them too.

Back to that research company. They asked if they could take me on as a consultant.

I signed up immediately.

My work was mostly advisory at this point, recommending how to use one or two hacks –mostly with digital skills and tech – on how to improve their development work.

Then in June, they’re like, we think you’re good at engaging our partners. And we want you to become a coordinator for the development project in Abuja.

So, my money got raised 20k a day. I had already switched to 5 days a week at this time. Some days, I’d work extra, and spread it out to make up for other days.

Interesting.

Also, my work involved a lot of travel across the region, so I was also getting travel allowances. I was travelling to Maiduguri, Kano, Jigawa, Kaduna, etc. Each trip, Breakfast is paid for, with my hotel fees. Then I got 3k for lunch, 3k for dinner, and another extra 2k for staying in that town.

Sometimes, I’d spend a week in a state, and they’ll pay me a per diem of 85k. Add my main 20k per diem.

20k plus 20 days. Quick math.

Important to note that, travel wasn’t consistent, but I know my average was about 500 to 550k per month.

By mid-2016, they said they wanted to make me a full-time staff. I remember them giving me this long speech because they thought I wouldn’t want to come in full time, but in my head, I’m like “you people, I full ground.”

In hindsight, maybe I would have stayed behind and collected more money as a consultant. But careerwise, it was a good move, because it meant more immersive responsibility.

By August 2016, my first salary was 280k, as part of a one year contract. No more per diem. Only extra money was from travel. I used to go to like two to three locations every month.

I started managing and coordinating not just small teams, but entire projects.

In a month, I might not even spend my salary on myself, but I’d still be comfortable. But, I also had other responsibilities that needed to be met, like family. I don’t drink, smoke, club, or juggle babes. So I had very little need to spend money outside of the usual stuff.

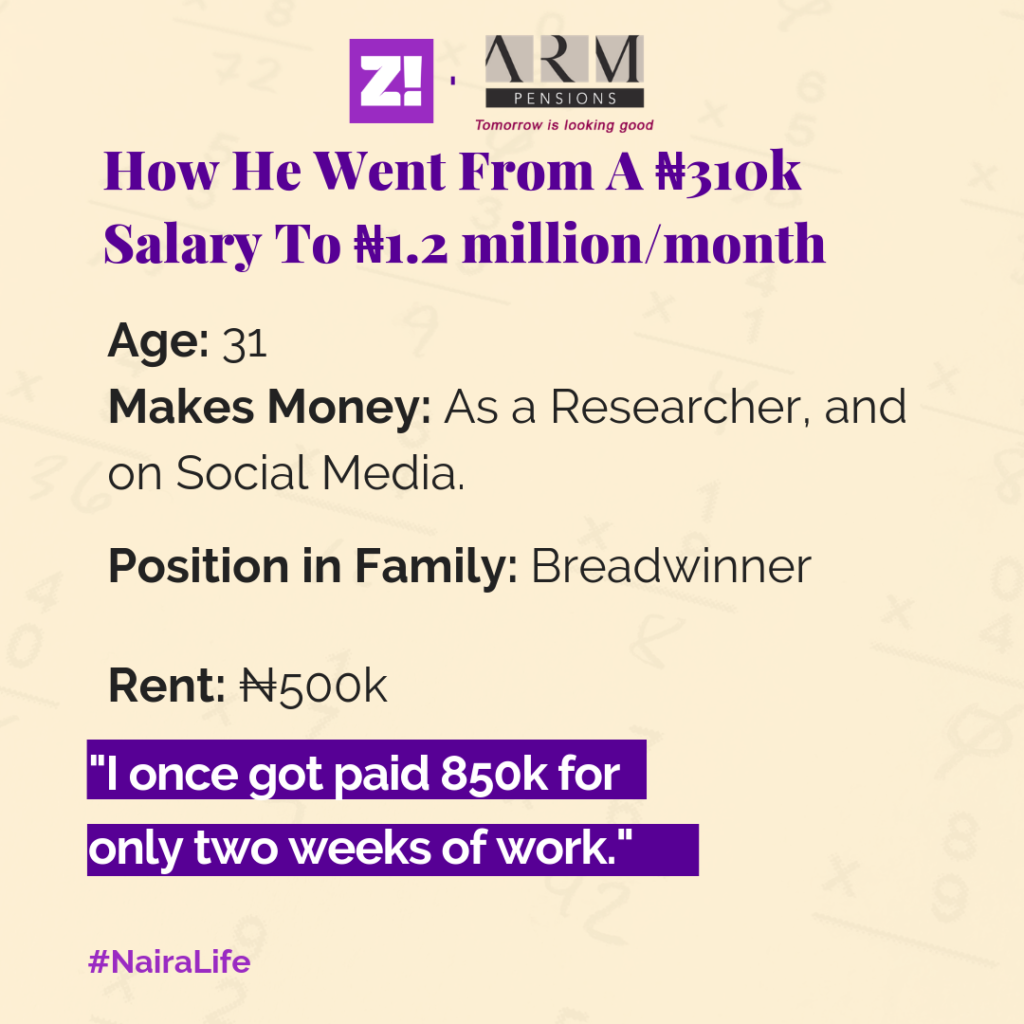

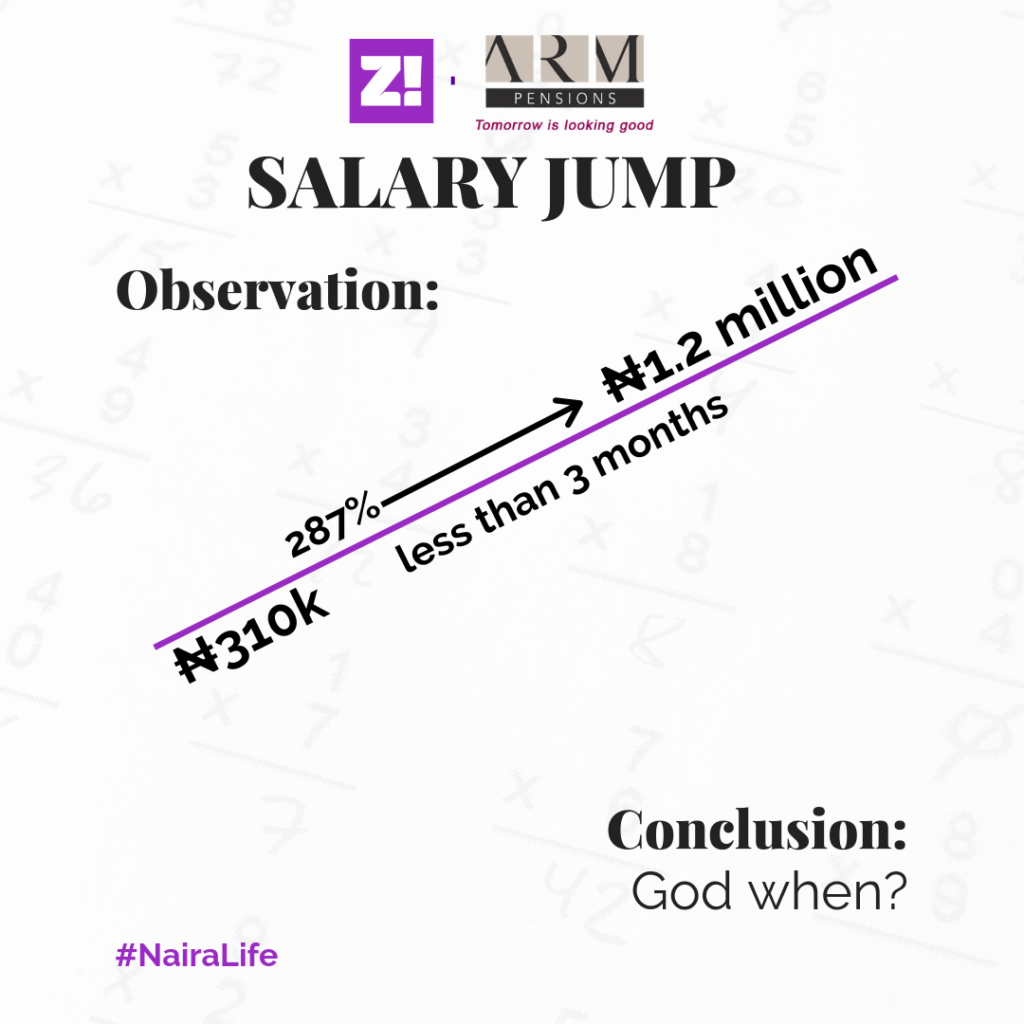

I got my next raise in mid-2018 when I got promoted and took home 310k.

My Social media gigs were coming more frequently, plus travel money. So I always had money week on week.

But you know the one thing I wasn’t doing in all this time?

What?

Saving. As the money was coming, I was just spending. I suck at saving. There’s no story like “oh I’m stashing 100k every month somewhere”. But what I did instead in that period was that, I bought two pieces of land, one 100 x 50 and another 50 x 50.

I started building a house for my mum. 2018 was when I took the worst hit. Every month, about 250k from my salary was going into that house. So –

– Quick one, how much did the entire house cost?

Actually, I had spent 2 million and hadn’t finished. The thing is, buying a house is more expensive but more convenient. But when you’re building, you have to micromanage everything. Keep in mind that the 2 million includes the land I bought.

But one of the things that helped a lot was that I have a friend who volunteered to design the house for free. Based on “our mumsy”. He even volunteered to help supervise every now and then.

It got to a point in 2018, I told myself, “guy you just dey work work. When are you going to enjoy?” So I spent money on vacationing, and that cost about 500k.

Enjoyment.

By 2019, I moved out from my family’s space, and paid the rent for my first space, 500k. Then my mum’s place – because the house wasn’t done – 250k. Then siblings’ school fees. That’s how things have been up till this point.

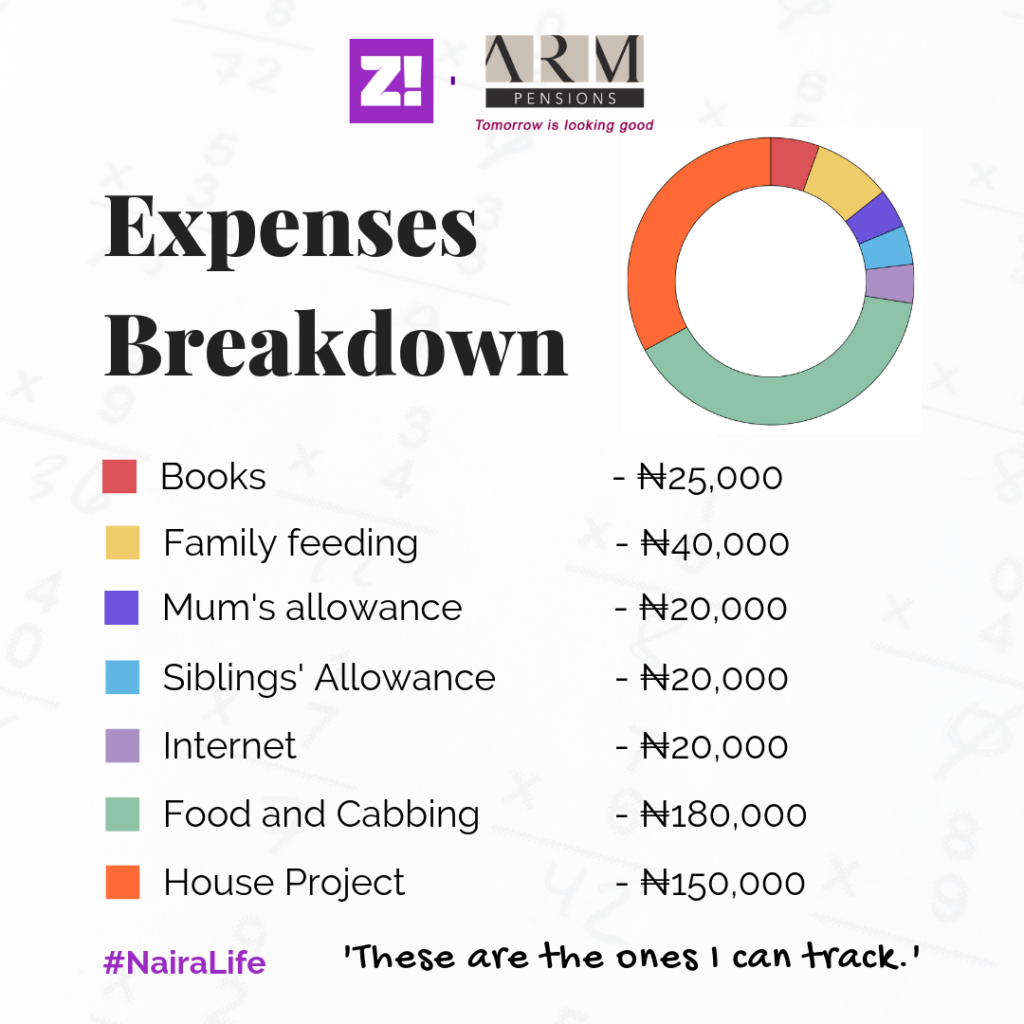

But, staying alone is expensive. Also, I started spending more on Ubers. I spend about 3-4k on Ubers everyday. Trips to work cost like 1,100 in the morning. And there’s the weekend part. Then I spend another 3k on food. This became like a constant running cost in my life.

*180k*

I tried investment at some point sha – twice. But bad management ruined them.

Random, but the biggest money I’ve earned at once in recent times, was that I helped someone work on a research project for two weeks, and I got paid 850k.

Wut?

Yep. Also, I had just resigned from my job, so add my 310k salary to that. But something interesting happened in all these years. Because of my bad saving habits, I was owing debts of over 300k. I’d randomly just hit up my guy and tell him to send me money etc.

Do you have a money rule?

Never run out of money – number one rule. I have too many responsibilities to run out of money. When it comes to money, I never tell my family no. I never even let them know when I’m broke. I just send money every time they need it.

I end up spending money on my dependents more than I do on myself.

Time for the audit.

My money situation is very messy, because I’m getting it from multiple sources, but I’m not always tracking every dime properly.

So, what’s next?

I have another job I’m going to resume at. My take-home is going to be about 1.2 million after tax. It’s actually going to be in Forex, but that’s what it comes to when it’s changed to naira.

Forex is a Nigerian dream.

Yes. One of my friends has been earning in forex for over four years now. I don’t even joke around with it. I basically go to her to teach me how to constantly find opportunities like that.

What’s the hack for earning in Forex?

I really dunno if there’s a direct hack. But I think that, as people are growing, they should always identify opportunities in their fields that exist outside the country. If you’ve been doing something for so long and you’ve gotten good at it, you should be checking career pages of international organisations operating in Nigeria.

Some people write so well, and a lot of these organisations are looking for technical writers and researchers and so on. Many of them pay in Forex. There are some roles where they pay in naira, but if they’re a foreign development organisation operating in Nigeria, they’re probably paying some people in forex, and you want to be part of them.

Don’t limit yourself and say, “oh I’m earning 200k. I can’t apply for a job that’s paying 2 million.”: You’d be surprised that your skill is what they’re looking for.

What are your earnings looking like 5 years from now?

All things being equal, I’ll be earning about 2.5 million a month. But for the next year or two, it’s looking like maybe 1.2-1.5 million a month.

What about in 30 years?

Well, there’s my pension. To be honest, I think it’s necessary, to just earn and know some of it is being kept safely for much later.

On a scale of 1-10, what’s financial happiness looking like for you?

For now, I’d say 6. Because what I earn is enough to take care of my immediate problems and dependencies. My next salary will take me to an 8. Because that’s when I can now begin to save and invest effectively.